Exploring the realm of digital insurance apps tailored for online business owners, this introduction sets the stage for a comprehensive look at the topic.

Highlighting the key aspects of digital insurance apps and their significance in today's online business landscape.

Overview of Digital Insurance Apps

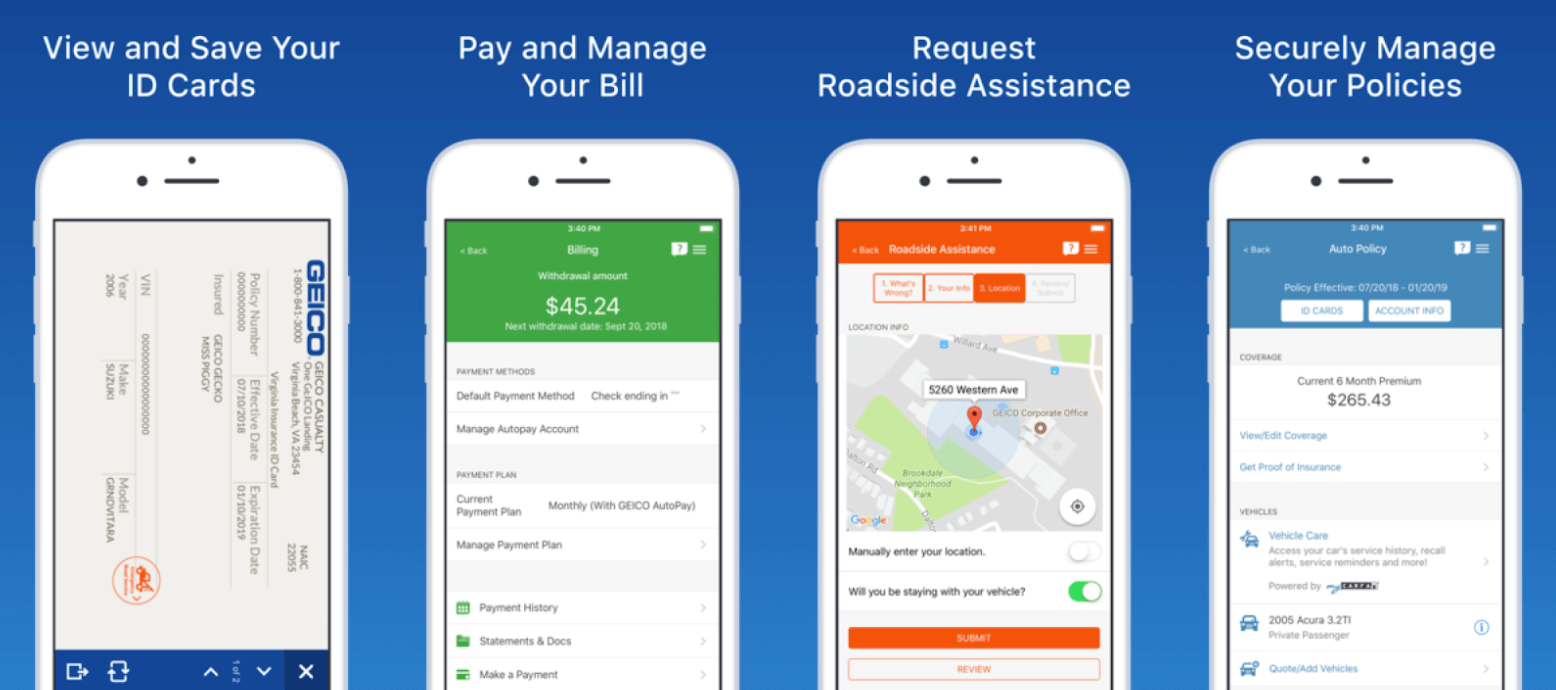

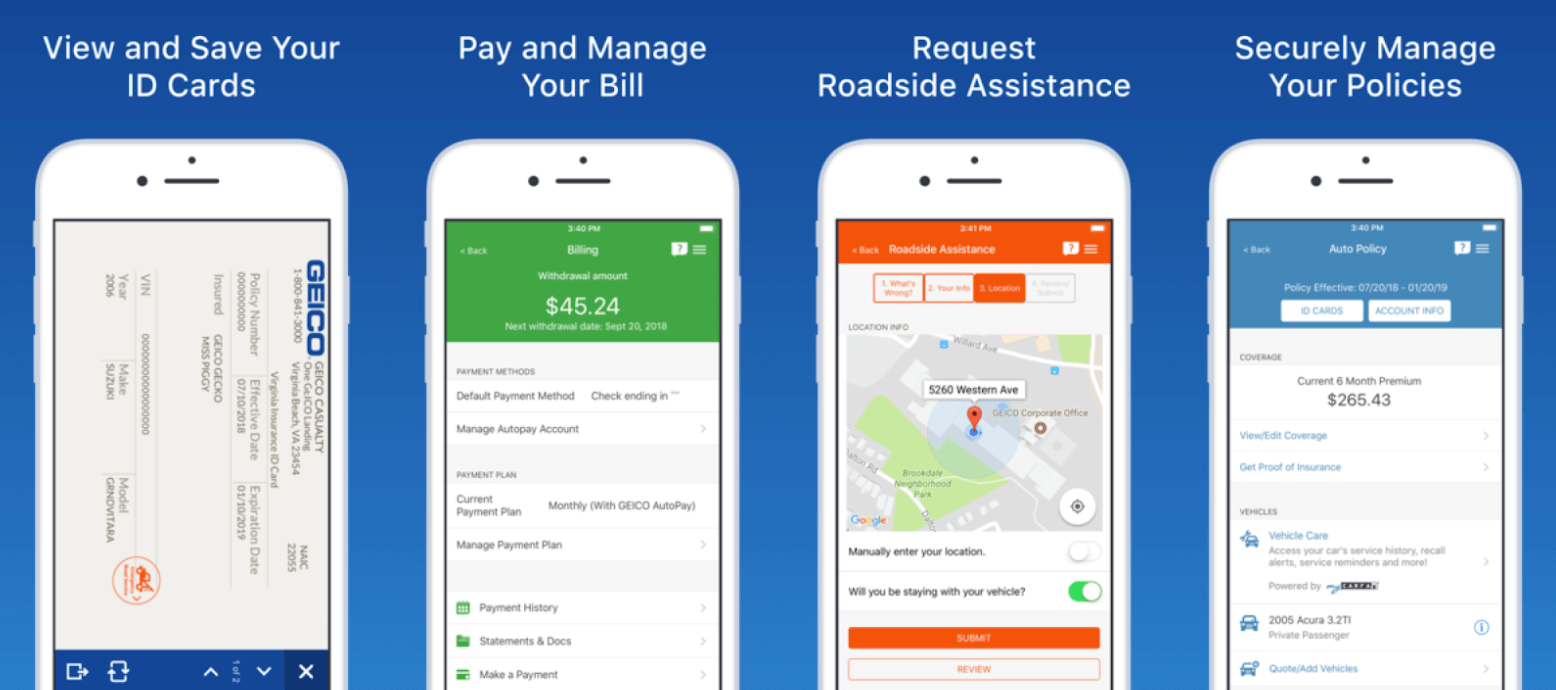

Digital insurance apps for online business owners are innovative tools that provide quick and convenient access to insurance coverage tailored to the specific needs of digital businesses. These apps streamline the insurance process, allowing business owners to manage their policies, file claims, and access support services all in one place.

Benefits of Digital Insurance Apps for Business Owners

- Convenience: Business owners can easily manage their insurance policies and claims through a user-friendly mobile app, saving time and effort.

- Customization: Digital insurance apps offer flexible coverage options that can be tailored to the unique risks and requirements of online businesses.

- Instant Access: With real-time updates and notifications, business owners can stay informed about their coverage and any policy changes.

- Cost-Effective: By eliminating the need for paperwork and manual processes, digital insurance apps can help reduce administrative costs for businesses.

Importance of Digital Insurance Coverage for Online Businesses

Having digital insurance coverage is crucial for online businesses due to the ever-evolving landscape of cyber threats and data breaches. With the increasing reliance on digital platforms, businesses are vulnerable to cyber attacks, fraud, and other online risks. Digital insurance provides financial protection and support in the event of a cyber incident, ensuring that businesses can recover quickly and continue operations without major disruptions.

Features to Look for in Digital Insurance Apps

When choosing a digital insurance app for your online business, there are several key features to consider. These features can help streamline insurance processes, improve efficiency, and provide better coverage for your business.

Customizable Policies

- Look for digital insurance apps that offer customizable policies tailored to the specific needs of your online business.

- Customizable policies allow you to select coverage options that are relevant to your industry and risk profile.

- Having the flexibility to adjust policy features can help you optimize coverage while managing costs effectively.

Instant Claims Processing

- Choose a digital insurance app that provides instant claims processing to expedite the settlement of claims.

- Instant claims processing reduces the time and effort required to file and resolve insurance claims, minimizing business disruptions.

- Efficient claims processing can help you get back on track quickly after an unexpected event or loss.

Integration with Business Tools

- Consider digital insurance apps that offer integration with your existing business tools and platforms.

- Integration with tools such as accounting software, CRM systems, and project management platforms can streamline insurance management processes.

- Having all your business tools connected to your insurance app can improve data accuracy, reporting capabilities, and overall efficiency.

Risk Assessment and Management Tools

- Look for digital insurance apps that provide risk assessment and management tools to help you identify and mitigate potential risks.

- These tools can offer insights into risk exposure, recommend risk prevention strategies, and help you make informed decisions to protect your business

.

- Effective risk assessment and management tools can minimize insurance claims, reduce premiums, and enhance overall business resilience.

Top Digital Insurance Apps for Online Business Owners

When it comes to protecting your online business, having the right digital insurance app can make all the difference. Here are some of the best options available in the market that cater specifically to the needs of online business owners.

1. Embroker

Embroker is a digital insurance platform that offers a wide range of insurance products tailored for online businesses. One of its unique selling points is its user-friendly interface that allows business owners to easily navigate through different insurance options. Embroker also provides personalized insurance plans based on the specific needs of each business, ensuring comprehensive coverage.

2. Next Insurance

Next Insurance is another popular choice among online business owners due to its quick and easy application process. This app specializes in providing insurance solutions for small businesses, including online retailers and freelancers. With Next Insurance, users can access affordable and customizable insurance plans that offer protection against various risks.

3. CoverWallet

CoverWallet is known for its innovative approach to digital insurance, offering a seamless online platform for business owners to manage their insurance policies. This app caters to a wide range of industries, including e-commerce, tech startups, and consulting firms. CoverWallet stands out for its competitive pricing and responsive customer support, making it a top choice for many online business owners.

User Reviews and Ratings

While each of these digital insurance apps has its own set of features and benefits, user reviews and ratings can provide valuable insights into the overall user experience. Positive reviews often highlight the ease of use, affordability, and reliability of these apps, while constructive feedback may point out areas for improvement such as customer service responsiveness or policy coverage limitations.

Tips for Using Digital Insurance Apps Effectively

Online business owners can optimize the benefits of digital insurance apps by following these tips:

Integrating Digital Insurance Apps into Business Processes

- Identify key areas where insurance coverage is needed within your business operations.

- Ensure that the chosen digital insurance app aligns with your specific business needs and risks.

- Train staff on how to effectively utilize the app to streamline insurance claims and policy management.

- Regularly review and update insurance policies on the app to reflect any changes in your business.

Ensuring Data Security and Privacy

- Choose digital insurance apps that prioritize data encryption and secure login processes to protect sensitive information.

- Regularly update the app to the latest version to ensure security patches are in place.

- Implement strong password practices and enable two-factor authentication for added security.

- Review the app's privacy policy to understand how your data is collected, stored, and shared.

Last Recap

In conclusion, the discussion on Best Digital Insurance Apps for Online Business Owners encapsulates the essence of the topic, offering valuable insights and practical advice for entrepreneurs navigating the digital insurance realm.

Digital insurance apps for online business owners are innovative tools that provide quick and convenient access to insurance coverage tailored to the specific needs of digital businesses. These apps streamline the insurance process, allowing business owners to manage their policies, file claims, and access support services all in one place.

Digital insurance apps for online business owners are innovative tools that provide quick and convenient access to insurance coverage tailored to the specific needs of digital businesses. These apps streamline the insurance process, allowing business owners to manage their policies, file claims, and access support services all in one place.

When choosing a digital insurance app for your online business, there are several key features to consider. These features can help streamline insurance processes, improve efficiency, and provide better coverage for your business.

When choosing a digital insurance app for your online business, there are several key features to consider. These features can help streamline insurance processes, improve efficiency, and provide better coverage for your business.

When it comes to protecting your online business, having the right digital insurance app can make all the difference. Here are some of the best options available in the market that cater specifically to the needs of online business owners.

When it comes to protecting your online business, having the right digital insurance app can make all the difference. Here are some of the best options available in the market that cater specifically to the needs of online business owners.