Exploring the world of insurance solutions for modern business buildings unveils a crucial aspect of protecting your valuable assets. From safeguarding against natural disasters to mitigating risks of theft and vandalism, insurance plays a pivotal role in ensuring the security and continuity of your business operations.

Let's delve deeper into the realm of insurance tailored for modern business structures.

Importance of Insurance for Modern Business Buildings

Modern business buildings face various risks that can result in financial losses and disruptions to operations. These risks include natural disasters, theft, vandalism, and other unforeseen events that can damage or destroy property.

Protection Against Natural Disasters

Insurance solutions provide coverage for damages caused by natural disasters such as earthquakes, hurricanes, floods, and wildfires. This coverage helps businesses recover and rebuild in the aftermath of such events, minimizing financial losses.

Security Against Theft

Insurance can protect business buildings from theft, providing coverage for stolen property and damages caused by break-ins. This security measure ensures that businesses can replace stolen items and repair any damages without bearing the full cost.

Defense Against Vandalism

Insurance also offers protection against vandalism, covering repairs for damages caused by graffiti, broken windows, or other acts of vandalism. This coverage helps maintain the appearance and integrity of the building, preserving its value.

Types of Insurance Coverage for Modern Business Buildings

When it comes to protecting modern business buildings, there are several types of insurance coverage available. Each type serves a specific purpose in safeguarding the business from financial losses due to unforeseen events. Let's explore the key types of insurance coverage for modern business buildings.

Property Insurance

Property insurance is designed to protect the physical structure of the business building as well as its contents. This type of insurance can cover damages caused by fire, theft, vandalism, natural disasters, and other perils. For example, if a fire breaks out and damages the building, property insurance can help cover the cost of repairs or rebuilding.

Liability Insurance

Liability insurance is essential for protecting businesses from legal claims and lawsuits. This type of insurance provides coverage for bodily injury or property damage that occurs on the business premises. For instance, if a customer slips and falls inside the building, liability insurance can help cover medical expenses and legal fees if the customer decides to sue the business.

Business Interruption Insurance

Business interruption insurance is designed to help businesses recover financially after a covered event disrupts operations. This type of insurance can provide compensation for lost income, ongoing expenses, and relocation costs if the business needs to temporarily shut down due to damage to the building.

For example, if a severe storm causes extensive damage to the building, business interruption insurance can help cover the loss of income during the rebuilding process.Overall, having a combination of property insurance, liability insurance, and business interruption insurance can provide comprehensive coverage for modern business buildings, ensuring that the business is protected from various risks and uncertainties.

Factors to Consider When Choosing Insurance Solutions

When selecting insurance for their buildings, businesses need to carefully consider various factors to ensure they have the right coverage in place. Factors such as the location, size, and nature of the business can significantly impact their insurance needs. It is crucial to assess risks and ensure adequate coverage to protect their assets and livelihood.

Location

The location of a business building plays a critical role in determining the insurance needs

. Buildings located in areas prone to natural disasters such as floods, earthquakes, or hurricanes may require additional coverage to protect against specific risks. Insurance premiums may also vary based on the crime rate and proximity to fire stations or emergency services.

Size

The size of the business building, including the square footage and number of floors, can influence the insurance coverage needed. Larger buildings may have higher replacement costs in case of damage or destruction, requiring higher coverage limits. Additionally, factors like the age of the building and the materials used in construction can impact insurance premiums.

Nature of Business

The nature of the business conducted in the building can also affect insurance requirements. For example, businesses that deal with hazardous materials or heavy machinery may need specialized coverage for liability and property damage. It is essential to accurately assess the risks associated with the business operations to ensure comprehensive coverage.

Risk Assessment

Before choosing insurance solutions, businesses must conduct a thorough risk assessment to identify potential hazards and vulnerabilities. Understanding the specific risks faced by the business building can help determine the type and amount of coverage needed. By evaluating the likelihood of different perils and their potential impact, businesses can tailor their insurance policies to mitigate risks effectively.

Adequate Coverage

Ensuring adequate coverage is crucial to protect against unexpected events that could result in financial loss or business interruption. Businesses should carefully review their insurance policies to confirm that they have sufficient coverage limits for property damage, liability claims, business interruption, and other potential risks.

Regularly reassessing insurance needs based on changes in the business environment or property upgrades is essential to maintain adequate protection.

Trends in Insurance Solutions for Modern Business Buildings

In today's rapidly evolving business landscape, insurance solutions for modern business buildings are also adapting to new trends and advancements. Let's explore some of the emerging trends in the insurance industry related to modern business buildings:

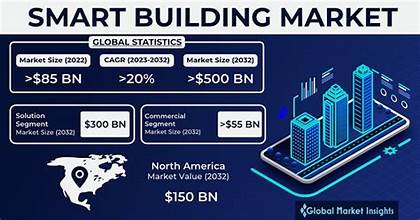

Advancements in Technology

Technology is playing a crucial role in shaping insurance solutions for modern business buildings. With the rise of IoT (Internet of Things) devices and smart sensors, insurers are able to gather real-time data on building conditions and potential risks. This data can be used to tailor insurance policies more accurately and efficiently.

Innovative Insurance Products

Insurance providers are introducing innovative products specifically designed to meet the unique needs of modern businesses. For example, some insurers offer cyber insurance coverage to protect businesses from cyber threats and data breaches, which have become increasingly common in the digital age.

Sustainable and Green Building Coverage

As sustainability and environmental consciousness become top priorities for businesses, insurance solutions are also adapting to cover sustainable and green buildings. Insurers are offering specialized coverage options for buildings with eco-friendly features, such as solar panels, green roofs, and energy-efficient systems.

Outcome Summary

In conclusion, the realm of insurance solutions for modern business buildings is vast and essential. By understanding the risks, exploring different types of coverage, considering key factors in selection, and staying updated on emerging trends, businesses can navigate the complexities of insurance with confidence.

Safeguard your business buildings with the right insurance solutions today.

User Queries

What are the key risks modern business buildings face?

Modern business buildings face risks such as natural disasters, theft, vandalism, and business interruptions that can disrupt operations and pose financial threats.

How does insurance protect against common threats like natural disasters?

Insurance provides coverage for damage caused by natural disasters, helping businesses recover and rebuild without bearing the full financial burden of repairs.

What factors should businesses consider when choosing insurance solutions for their buildings?

Businesses should consider factors like location, building size, nature of operations, and potential risks specific to their industry to ensure adequate coverage that meets their needs.